Get the free 540x pdf form

Show details

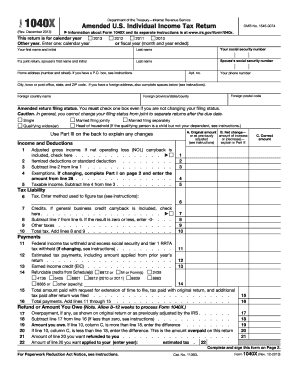

Instructions for Form 540X Amended Individual Income Tax Return References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 540x pdf form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 540x pdf form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 540x pdf online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 540x form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out 540x pdf form

How to fill out 540x:

01

Start by gathering all the necessary information and documents required to complete the form.

02

Carefully read the instructions provided on the form to understand the specific information that needs to be filled in each section.

03

Begin filling out the form by entering your personal details such as your name, address, and contact information.

04

Proceed to provide all the required financial information, including income, deductions, and credits, as applicable.

05

Double-check each section to ensure accuracy and completeness before moving on to the next.

06

If you encounter any difficulties or have questions while filling out the form, refer to the instructions or seek assistance from a tax professional or the appropriate authority.

07

Once all the information has been entered correctly, review the form one last time to verify its accuracy.

08

Sign and date the form as required and submit it according to the instructions provided.

Who needs 540x:

01

Individuals who have identified errors on a previously filed California income tax return (Form 540) and need to correct those errors.

02

Taxpayers who have changes in circumstances that affect their income, deductions, or credits, which were not accounted for in their original tax return.

03

Individuals who have received correspondence from the California Franchise Tax Board directing them to use Form 540X to make adjustments or corrections to their previously filed tax return.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 540x?

The product of 540 multiplied by x is simply 540x, which represents the multiplication of the number 540 by the variable x.

Who is required to file 540x?

Individuals who have made a mistake or need to correct their California state income tax return must file Form 540X, Amended Individual Income Tax Return. This form is used to make changes to a previously filed Form 540, California Resident Income Tax Return, or Form 540NR, California Nonresident or Part-Year Resident Income Tax Return.

How to fill out 540x?

Form 540X, also known as the California Amended Individual Income Tax Return, is used to correct any errors or omissions on a previously filed California state tax return (Form 540 or 540NR). Here's how you can fill out Form 540X:

1. Obtain the necessary documents: Gather your original Form 540 or 540NR, as well as any supporting documents attached to it, such as W-2s, 1099s, or schedules.

2. Download Form 540X: You can find the Form 540X on the California Franchise Tax Board (FTB) website or obtain a copy from a local FTB office.

3. Section 1 - Basic Information:

- Provide your name, Social Security number, and the tax year for which you are filing the amended return.

- If you previously filed as part of a married/registered domestic partnership couple, enter your spouse's/RDP's name and SSN.

4. Section 2 - Reason for Amending: Indicate the reason for filing Form 540X by selecting the appropriate checkboxes. There are various reasons, such as correcting income, deductions, credits, or filing status.

5. Section 3 - Explanation of Changes:

- Explain the specific changes you are making in this section. Provide an accurate and detailed description of the changes you are making and the reasons behind them.

- Use additional sheets if necessary, but make sure to indicate which line or schedule you are explaining.

6. Section 4 - Income, Deductions, and Credits:

- Go through each line that needs to be amended and enter the revised amounts.

- If reporting additional income or claiming additional deductions or credits, provide the details on the appropriate lines.

7. Section 5 - Refund or Amount You Owe:

- Calculate the difference between the original and amended tax amounts you owed.

- If you are owed a refund, provide your preferred refund option (direct deposit or check).

- If you owe additional tax, include the payment with Form 540X.

8. Section 6 - Sign and Date: Sign and date the form indicating that you have completed it accurately and to the best of your knowledge.

9. Supporting Documentation: Attach copies of any supporting documents that substantiate the changes you made on Form 540X. This includes W-2 forms, 1099s, schedules, or any other relevant documentation.

10. Filing the Form 540X: Mail the completed Form 540X, along with any supporting documents, to the California Franchise Tax Board. The address is provided on the form itself, and you should keep a copy of the form for your records.

It's important to note that Form 540X can only be used to correct California state tax returns filed using Form 540 or 540NR. If you need to amend a federal tax return, you should use IRS Form 1040X instead.

What is the purpose of 540x?

540x refers to a resolution option often used in computer graphics and video formats. It represents the number of horizontal pixels (540) in the width of the screen or image, multiplied by the number of vertical pixels in the height (x). The purpose of 540x would depend on the context in which it is being used. In general, the purpose is to provide a specific resolution for displaying or capturing visual content, such as images, videos, or graphical interfaces. This resolution can be chosen based on desired image quality, compatibility with specific devices or platforms, or other specific requirements.

What information must be reported on 540x?

Form 540X is used to amend a California tax return. When filing this form, you must report the following information:

1. Personal Information: This includes your name, social security number, and contact information.

2. Filing Status: Indicate whether you are filing as a single individual, married filing jointly, head of household, etc.

3. Income: Provide details of any changes to your income, such as adjustments to wages, self-employment income, rental income, or investment income.

4. Deductions: Report any changes to your deductions, including itemized deductions or adjustments to the standard deduction.

5. Tax Credits: If applicable, report any changes to tax credits you are eligible for, such as the child tax credit or education credits.

6. Additional Tax: If there is any additional tax owed as a result of the amendment, you must report it.

7. Refund: If you are due a refund from your original return, report the amount here.

8. Explanation: Include a detailed explanation of the changes being made and the reasons for filing the amended return.

9. Supporting Documents: Attach any necessary documentation to support the changes being made, such as revised W-2 forms, 1099s, or receipts.

Remember to sign and date the form before submitting it to the California Franchise Tax Board.

When is the deadline to file 540x in 2023?

The deadline to file form 540X in 2023 would be April 15th, 2023.

What is the penalty for the late filing of 540x?

The penalty for the late filing of Form 540X, which is the Amended Individual Income Tax Return, depends on several factors. Generally, if you file the amended return within 60 days of the original due date of your tax return or within 60 days of the date you paid any additional tax due, there is no penalty. However, if you file your amended return after this 60-day grace period, you may be subject to a late filing penalty.

The late filing penalty is usually 5% of the additional tax due for each month or part of a month that your return is late, up to a maximum of 25% of the additional tax due. Additionally, if the IRS determines that your failure to file the amended return was due to fraud, the penalty can be increased to 75% of the additional tax due.

It's important to note that penalties and interest may vary depending on the specific circumstances and tax laws of your jurisdiction. It is recommended to consult with a tax professional or refer to the official tax guidelines for accurate and up-to-date penalty information.

How do I execute 540x pdf online?

With pdfFiller, you may easily complete and sign 540x form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an eSignature for the 540x instructions in Gmail?

Create your eSignature using pdfFiller and then eSign your how to fill out form 540x immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit 540x pdf on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 540x form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your 540x pdf form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

540x Instructions is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.